how to get amazon flex tax form

2 Go to the Reports Section. If you have not received your Form W-2 by the due date and have completed steps 1 and 2 you may use Form 4852 Substitute for Form W-2 Wage and Tax Statement.

![]()

How Much Tips Do You Earn With Amazon Flex Prime Now Deliveries Money Pixels

If you think you should have received a form 1099-K but didnt you can check on it in your Seller Central Account.

. Use your own vehicle to deliver packages for Amazon as a way of earning extra money to move you closer to your goals. In your example you made 10000 on your 1099 and drove 10000 miles. This is the non-employee compensation 1099 form you receive from Amazon Flex if you earn at least 600 with them if it is under 600 you will not receive the form -- but still have to report the income otherwise youll receive filing penalties.

This is where you enter your delivery income and business deductions. We will issue a 1099 form by January 29 to any Amazon Associate who received payments of 600 or more or received payments where taxes were withheld in the previous calendar year unless you are an exempt entity. From the Reports section select Tax Document Library followed by the appropriate year and then Form 1099-K.

Payee and earn income reportable on Form 1099-MISC eg. Generally payments to a corporation including a limited liability company LLC that is treated as a C- or S-Corporation do not receive. You can also retrieve the form from your seller account.

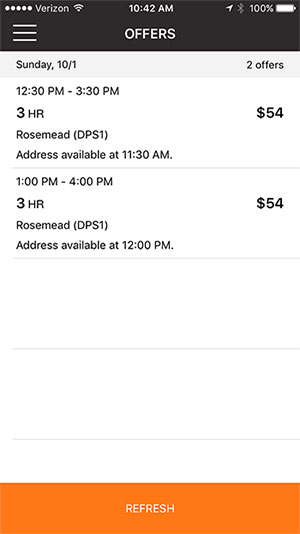

Get started now to reserve blocks in advance or pick them daily based on your schedule. With Amazon Flex you work only when you want to. There may be a delay in any refund due while the information is verified.

Bundle includes everything you need for 25 employees including 13 w2 copy a forms 13 w2 copy b forms 25 w2 copy c2 forms 25 w2 copy d1 forms 3 w3 transmittal forms and 25 self sealing envelopes all designed to be compatible with quickbooks. Schedule C is part of. Gig Economy Masters Course.

Understand that this has nothing to do with whether you take the standard deduction. Ad access any form you need. Click the Download PDF link.

Amazon Flex Business Phone. Increase Your Earnings. 1 Login to Seller Central.

Scroll down to the Year-End Tax Forms section. The irs requires s to be sent out by january 31st. Amazon Flex Legal Business Name.

Amazon flex tax forms 2019. In other words you do not work for amazon. This is your business income on which you owe taxes.

Amazon Flex Business Address. Attach Form 4852 to the return estimating income and withholding taxes as accurately as possible. Most drivers earn 18-25 an hour.

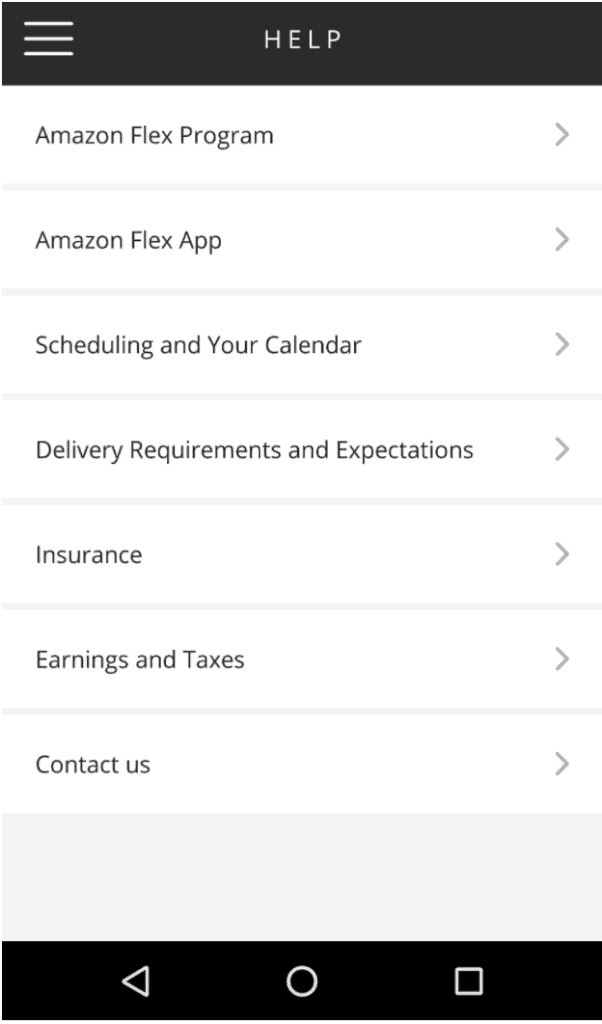

To download your form electronically follow these steps. The main tax form you need to file is Schedule C. As an independent contractor you will use the information on form 1099 from amazon flex to complete schedule c and schedule se which in turn are needed to complete sections of form 1040 that pertain to your amazon flex earnings and tax amounts.

In the Year-end tax forms section click Find Forms Click Download. Do you get taxed on Amazon Flex. Youll need to declare your amazon flex taxes under the rules of HMRC self-assessment.

Royalty or rent income by participating in one or more Amazon programs you may be eligible to receive a 1099-MISC if you meet the reporting threshold 10 for royalties and 600 for all other payments. 410 Terry Avenue North Seattle WA 98109 What forms do you file with your tax return. Amazon will either mail or email you your form 1099-K depending on whether or not you consented to having tax forms sent to you electronically.

If you are a US. Not every Amazon seller gets a 1099-K form from Amazon. Ad access any form you need.

The Form 1099-K was mailed to the address you provided in the tax interview. This form will have you adjust your 1099 income for the number of miles driven. Will I also get a 1099-MISC form.

Ad We know how valuable your time is. To meet the requirements for a 1099-K you must have both 20000 in total sales and 200 individual transactions. Youll need to submit a tax return online declaring your income and expenses once a year by 31 January as well as paying tax twice a.

However if you have at least 50 transactions you still need to provide your tax status to Amazon.

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To Get 1099 From Amazon Flex Bikehike

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Completing Your Tax Information In Seller Central For Amazon Payments Youtube

How To Do Taxes For Amazon Flex Youtube

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

How To File Amazon Flex 1099 Taxes The Easy Way

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To File Amazon Flex 1099 Taxes The Easy Way

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Amazon Flex App Everything You Need To Know Full Tutorial Ridester

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable